The financial sector changes fast. Artificial Intelligence, or AI, drives this change. AI does not just improve old ways. It reshapes banking and investments. This includes customer talks, risk controls, trading plans, and rule following.

Adopting AI is now necessary for financial institutions. AI offers faster work and better security for banks. It helps banks give personal services. These services serve customers better. AI gives investors good tools. These tools predict outcomes, trade automatically, and manage money. They may give better returns and reduce human error. Customers get faster service and financial products fit their needs. The financial system becomes safer. People in finance, investors, and policymakers must understand these changes.

This guide explains:

- AI’s role in the changing financial world.

- How AI changes customer service and personal finance.

- How AI makes risk management stronger and finds fraud.

- AI uses in managing investments and money.

- AI’s effect on faster operations and automation.

- AI’s role in following rules and fighting financial crime.

- AI in finance faces challenges. It has ethical questions and new chances.

Contents

- 1 The Dawn of AI in Finance: A New Era

- 2 Changing Customer Experience and Personalization

- 3 Making Risk Management Stronger and Finding Fraud

- 4 Improving Investment Strategies and Money Management

- 5 Making Operations Faster and Automated

- 6 Following Rules and Fighting Financial Crime

- 7 The Future Landscape: Challenges, Ethics, and New Chances

- 8 Conclusion

The Dawn of AI in Finance: A New Era

The finance world always used data. This includes transaction records and market changes. Today, data volume and speed are too big for humans to analyze. Artificial Intelligence helps here. AI processes, reads, and learns from big data fast and without mistakes. AI is not a small improvement. It changes how financial services work, how people use them, and how rules apply. AI reaches every part of finance. This goes from office tasks to talking with customers. AI promises a future with more speed, security, and personal service.

Defining Artificial Intelligence in Financial Contexts

AI in finance covers many methods. These include machine learning (ML), natural language processing (NLP), computer vision, and robotic process automation (RPA).

- Machine Learning (ML): ML lets systems learn from data without direct programming. In finance, ML finds patterns in market data. It predicts credit defaults or finds bad transactions. ML can forecast money trends. Supervised, unsupervised, and reinforcement learning help solve finance problems.

- Natural Language Processing (NLP): NLP lets computers understand and make human language. NLP helps analyze news feelings for trades. It takes ideas from earnings reports. It powers smart chat programs for customers. It summarizes legal papers for rules.

- Robotic Process Automation (RPA): RPA makes repetitive, rule-based tasks automatic. Humans did these tasks before. In finance, RPA does data entry or handles bills. It makes reports or matches accounts. This frees people for more important work.

- Predictive Analytics: This uses math methods and machine learning. It finds the chance of future results based on old data. This helps with risk checks, customer behavior ideas, and market forecasts.

Historical Trajectory and Current Adoption Rates

AI ideas existed for decades. Its use in finance grew with big data, better computing power, and new methods. Early uses were for trade models. Today, AI is everywhere. Big financial groups spend billions on AI. They know AI can give them an advantage. A recent survey shows 80% of financial groups think AI will change their business within five years. Banks and new finance companies use AI. It moves from experiments to core plans. Its use shows AI is not just a technology. It is a main change in how finance creates and gives value.

Changing Customer Experience and Personalization

Customers now expect more. AI helps financial groups give personal, smooth, and quick experiences. Old one-size-fits-all services are gone. AI helps banks and investment firms understand what each person needs. This builds stronger ties and loyalty.

Intelligent Chatbots and Virtual Assistants

Smart chat programs and virtual helpers are a clear AI use in customer service. These AI agents handle many customer questions all day, every day. They answer common questions about money and past transactions. They help reset passwords. They guide users through hard application steps. Older chat programs used fixed rules. New AI helpers understand normal language. They learn from talks. They give more detailed answers. This reduces calls and wait times. It gives instant help. This improves customer happiness. It frees human agents for harder, more caring issues. Bank of America’s Erica and Capital One’s Eno are examples.

Hyper-Personalized Financial Products and Services

AI can look at large amounts of customer data. This includes past spending, money patterns, credit scores, and life events. It can even use social media activity if allowed. This lets financial groups move past general offers. AI programs find personal money goals and risk comfort. They suggest fitting products and services. This might mean custom loan offers or smart savings plans. It could mean personal investment advice. It might give quick alerts about too much spending. For example, an AI system might see a customer’s travel costs. It could then suggest a credit card with travel rewards. Or it might predict a house purchase. It could then offer mortgage choices. This personal care builds stronger customer ties. It increases product sales.

Predictive Customer Service and Retention

AI helps financial groups act before problems happen. They can predict when a customer might leave or face money trouble. AI looks at customer behavior and feelings. This allows banks to help quickly. They might offer money advice or change payment plans. They might simply reach out to fix issues early. AI checks also find valuable customers. It suggests ways to keep them. This makes sure the best relationships grow. This predictive skill changes customer service. It goes from a cost to a way to build ties and make money long term.

Making Risk Management Stronger and Finding Fraud

Risk management is key for finance. AI processes data fast and spots patterns. It has become a vital tool. AI finds, checks, and reduces many money risks. It makes the sector stronger against threats like fraud, credit defaults, and market changes.

Real-Time Anomaly Detection and Predictive Analytics

Old fraud systems used fixed rules. Smart criminals could bypass these rules. They also caused many false alarms. AI systems, using machine learning, find strange activities better. These systems learn from many past true and fake transactions. They set a normal behavior level. Any small difference, even if humans miss it, gets flagged as unusual. This happens at once. Action is swift, like stopping a transaction. This lowers possible losses. Predictive checks further help. They guess future fraud patterns before they fully appear. This comes from past trends and new dangers. This early action makes a group’s defenses much stronger.

Credit Scoring and Loan Underwriting with AI

AI changes how financial groups check credit and give loans. Beyond credit scores and income, AI programs use more data. This includes utility bill payments, rental history, and education. It can even use social media data if allowed and right. This builds a full, true risk profile for a person. This leads to better loan choices. It reduces defaults for lenders. It also helps more people get credit who might be left out by old ways. Machine learning finds complex links in data. Old math models might miss these links. This leads to fairer checks. It also speeds up loan steps, giving customers faster choices.

Market Risk Analysis and Stress Testing

Managing market risk is most important in the fast-changing investment world. AI tools change how financial groups check and predict market moves. They also predict possible drops and economic factor effects. AI models process large amounts of real-time market data. They also check news feelings, world events, and past trends. This gives good risk checks. They find how different assets and markets link. They simulate various tough situations. This shows how strong investments are. Human checks can have errors. AI gives an objective, data-based view. It helps groups make better choices for assets and risk in complex markets. This makes stress tests stronger. These tests are key for following rules and managing money wisely.

Improving Investment Strategies and Money Management

Investing is complex and uses much data. This makes it a good place for AI. From fast trading to personal money management, AI gives new ways to check, execute, and make things better. It promises to boost returns and lower risks for all investors.

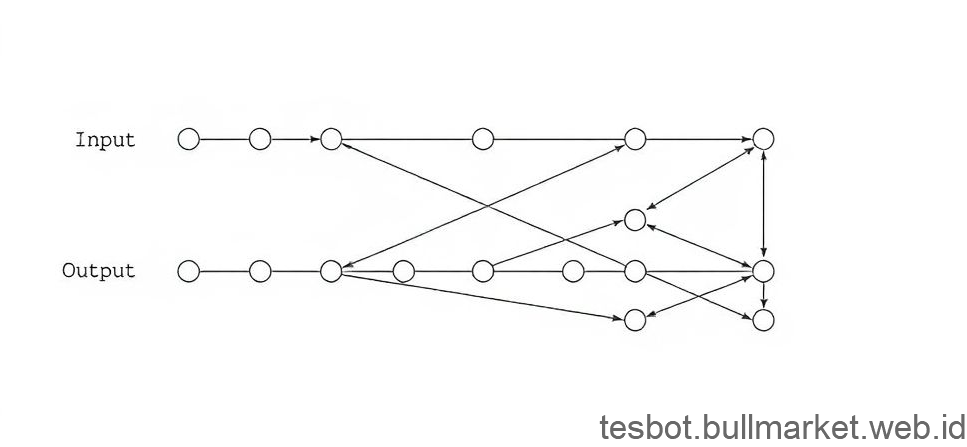

Algorithmic Trading and High-Frequency Trading (HFT)

AI is at the center of modern algorithmic trading. This includes High-Frequency Trading (HFT). AI programs check market data, news, social media feelings, and economic signals in milliseconds. They find quick chances humans cannot see. They make trades automatically. This happens based on set plans and market conditions. They use small price differences across exchanges. Machine learning models improve these plans always. They adjust to market changes. They get better at predicting. HFT has some debates about market fairness. Its speed and output are clear. Advanced AI powers it directly. It makes millions of trades per second. It helps market flow.

Robo-Advisors and Automated Wealth Management

For individuals, AI gives access to money advice through robo-advisors. These automatic systems use programs to build and manage money investments. They fit a person’s risk comfort, money goals, and time. A client answers questions. The robo-advisor then suggests the best asset mix. It automatically rebalances the investments to keep the right risk level. AI makes these services better. It gives personal money planning ideas. It helps with tax loss harvesting. It even gives helpful nudges. This lowers the cost of managing money greatly. It makes smart investment plans open to more people. Betterment and Wealthfront are leading examples.

Predictive Market Analysis and Sentiment Trading

AI is good at predicting market changes and understanding the feelings behind them. It also executes trades. Machine learning models check large amounts of data. This includes old prices, trade volumes, news stories, analyst reports, and company filings. They find patterns and predict future prices for stocks, goods, and currencies. Natural Language Processing (NLP) is very important here. It helps programs measure how the market feels about companies or sectors. This comes from text data. For example, an AI system might see a quick rise in bad feelings about a company on social media. This happens even before news reports show it. This could show a future stock price drop. This feeling-based trading gives a strong, data-based edge. It lets investors react to facts much faster than humans can.

Here’s a comparison table showing how AI changes key parts of investment:

| Investment Aspect | Old Way (Before AI) | AI-Driven Way |

|---|---|---|

| Market Analysis | Manual research, small data sets, human bias, slow news processing. | Real-time processing of large structured/unstructured data, feeling analysis, prediction models. |

| Money Management | Regular human checks, rule-based rebalancing, broad asset mix. | Automatic rebalancing, very personal asset mix, constant risk improvement. |

| Trade Execution | Manual order placement, broker talks, delay problems. | Algorithmic trading, very fast speed, best order routing, micro-second chances. |

| Risk Check | Old data checks, limited plan for situations, uses VaR models. | Changing risk profiles, real-time tough situation testing, prediction risk alerts for many factors. |

| Client Advice | Human money advisors, often for rich clients only, higher fees. | Robo-advisors, scalable, lower cost, open to more people, data-based suggestions. |

Making Operations Faster and Automated

AI also makes internal operations faster for financial groups. It automates common tasks. It speeds up work. It improves data processing. AI helps banks and investment firms lower costs. It makes things more accurate. It frees human workers for more important tasks.

Robotic Process Automation (RPA) in Back-Office Operations

RPA uses software robots, or bots. Bots act like humans when they use digital systems. In finance, this helps back-office work. This work often has many repeated, rule-based tasks. Examples include:

- Data Entry and Extraction: RPA bots read data from documents. This includes bills, forms, or emails. They put it into bank systems or spreadsheets. This stops human errors. It makes processing faster.

- Reconciliation: RPA makes matching transactions automatic. This happens between different systems. For example, bank statements and internal records. This ensures accuracy. It finds differences much faster than human checks.

- Report Generation: RPA can make routine reports automatic. This saves much time for analysts and rule-following staff.

- Payment Processing: RPA automates steps in payment work. This goes from checking to sending. It makes speed better and reduces errors.

RPA helps financial groups save much money. It improves data quality. It speeds up work. Human workers can then focus on analysis and customer tasks.

Streamlining KYC and Onboarding Processes

Knowing Your Customer (KYC) and client onboarding take much time. They cost much. They are key for following rules. AI changes these steps. It automates data collection, checks, and risk assessment.

- Document Verification: AI-powered computer vision and OCR scan and check ID documents fast. This includes passports or driver’s licenses. It checks for realness. It flags anything odd.

- Identity Verification: AI-powered facial recognition or fingerprint scans offer safe and quick ID checks during digital signup.

- Automated Background Checks: AI quickly searches large databases. It checks new clients against watchlists, bad media, and sanction lists. This speeds up the check process greatly.

- Risk Scoring: Machine learning programs give new clients a risk score. This comes from collected data. High-risk people get close checks. Low-risk people sign up faster.

This speeds up KYC work. It lowers costs. It also makes customer signup faster and smoother. This reduces how many people quit during signup.

Data Processing and Analytics Automation

The financial world makes huge amounts of data daily. AI is crucial for processing, sorting, and getting ideas from this big data fast.

- Automated Data Cleansing and Normalization: AI programs find and fix errors. They remove duplicates. They standardize data formats across different systems. This ensures data is good for analysis.

- Intelligent Data Categorization: Machine learning sorts financial transactions. It sorts customer talks and market data automatically. This makes searching, analyzing, and reporting easier.

- Automated Insights Generation: AI analysis finds trends, links, and strange things in data. Humans might miss these. It creates useful ideas for decisions. This helps with product work, selling, and better operations.

- Predictive Maintenance for IT Systems: AI can even guess problems in IT systems. This allows early fixes. It stops costly system stops. It makes sure key financial systems keep working.

AI automates these data tasks. Financial groups can then use all their data fully. They turn raw facts into smart ideas and fast operations.

Following Rules and Fighting Financial Crime

Finance works under many complex, changing rules. Not following rules can mean big fines and bad fame. AI helps with these rules. It makes compliance better. It strengthens defenses against money crime greatly.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF)

AML and CTF are key areas where AI makes a big impact. Old AML systems often flagged too many false alarms. This made checks slow. AI tools, using machine learning and network analysis, work much better.

- Advanced Anomaly Detection: AI programs check billions of transactions at once. They find unusual patterns, strange networks, and hidden links. These show money laundering or terror funding. They learn from past cases. This lowers false alarms. It also gets better at finding real bad acts.

- Behavioral Biometrics: AI checks user behavior patterns. This includes login times, device used, and usual transaction amounts. It finds differences that might mean account takeover or illegal use.

- Automated Case Management: When an odd act is flagged, AI helps gather data. It makes first reports. It can even rank cases for human investigators. This speeds up the whole AML work.

AI makes AML/CTF checks more accurate and faster. This helps groups follow strict rules. It also protects the world financial system from bad money.

Automated Compliance Monitoring and Reporting

Staying compliant with rules like GDPR, CCPA, Basel III, and others is a huge job. AI makes this job much easier.

- Regulatory Intelligence: NLP-powered AI watches many sources for rule updates. This includes legal papers and news. It alerts staff to changes that affect their work. It can summarize legal texts. It highlights key needs.

- Automated Policy Enforcement: AI can be put into core systems. This makes sure transactions, customer talks, and data handling follow internal rules and outside laws automatically. It stops breaches before they happen.

- Compliance Auditing and Reporting: AI automates data collection, checks, and reports for rule audits. It finds rule gaps. It shows risk areas. It makes accurate reports. This saves many hours. It reduces human errors in a task often done by hand.

- Contract Analysis: NLP checks legal contracts and agreements. It finds specific parts, risks, or rule needs. It speeds up legal checks. It ensures terms are met.

This automation lowers compliance cost greatly. It reduces risk of rule fines. It gives a stronger, clearer compliance system.

Sanctions Screening and Transaction Monitoring

Sanctions screening is a key part of compliance. Groups must not do business with people, groups, or countries on various global sanction lists. Transaction monitoring checks money transactions for strange or odd actions.

- AI-Enhanced Sanctions Screening: AI programs make sanctions screening more accurate. They reduce false alarms from name changes or cultural differences. They can use fuzzy matching, context checks, and aliases. This finds real matches better.

- Real-time Transaction Analysis: AI systems watch every transaction in real-time. They cross-check customer profiles, past behavior, and outside data. This flags bad transactions at once. Examples include very large transfers to risky places. Or many small deposits followed by a big withdrawal. Or transactions with sanctioned groups.

- Network Analysis: AI maps complex networks of transactions and links. It finds hidden ties between people and groups. These might try to hide their identity or actions. This works well for finding crime groups or complex money laundering plans.

AI gives real-time, smart monitoring. It offers financial groups a strong way to stop money crime. It ensures following world sanctions. It protects their integrity and the global financial system.

The Future Landscape: Challenges, Ethics, and New Chances

AI changes finance clearly. But its wide use brings big challenges. It also brings ethical points and new chances. Financial groups must handle these well to get full benefits.

Data Privacy and Cybersecurity Concerns

AI systems need much data. They use large amounts of sensitive money and personal facts. This increases worries about data privacy and computer security.

- Data Security: Protecting this data from breaches, hacks, and wrong access is most important. Groups must invest in strong encryption and multi-factor logins. They need advanced threat finding systems. Many of these systems use AI.

- Regulatory Compliance (GDPR, CCPA): Following strict data privacy rules like GDPR and CCPA is harder with AI. These rules give people rights over their data. Transparent data use, consent, and the right to be forgotten are key.

- Bias in Data: AI models learn from training data. If this data has hidden biases, the AI will repeat them. This leads to unfair results. This is a big ethical and rule challenge. It shows in credit scoring and insurance. Fixing this needs careful data choice, bias finding programs, and explainable AI methods.

Ethical AI and Algorithmic Bias

AI’s ethical effects in finance are deep. AI makes important choices. This includes approving loans, setting insurance prices, and predicting market crashes. Fairness, clear steps, and accountability are key.

- Algorithmic Bias: Biased training data leads to unfair results. Financial groups must find and reduce these biases in their AI models. This means diverse data. It means bias finding tools and constant checks.

- Explainability (XAI): Many advanced AI models, like deep learning networks, are black boxes. It is hard to know how they make choices. Finance is a highly regulated field. Here, clarity and audit trail are needed. This lack of explainability is a big hurdle. Explainable AI (XAI) is a new field. It makes AI models that give human-understandable reasons for their outputs. Regulators ask for more clarity from AI systems.

- Accountability: An AI system might make a wrong or unfair choice. Who is to blame? The maker, the company using it, or the program itself? Clear rules for accountability must be made.

Workforce Transformation and Upskilling

AI will change financial workers. AI will automate many routine tasks. It will also create new jobs and need new skills.

- Job Changes: Some jobs might be cut. This includes data entry, basic customer service, and manual checks. But more jobs will appear. These include data scientists, AI engineers, and AI ethicists. Also, people who manage and read AI outputs.

- Upskilling: Financial groups must invest in training their workers. Teach them AI knowledge, data checks, and human-AI teamwork. Teach them problem-solving skills that work with AI. Future finance pros will likely work with AI. They will use its ideas to make better choices.

- Human-in-the-Loop: For key choices, a human is often needed. AI gives ideas. But the final choice stays with a human expert. This person adds judgment, understanding, and context.

The Promise of Quantum Computing and Explainable AI (XAI)

Two tech advances hold much promise for AI in finance.

- Quantum Computing: This is early but powerful. Quantum computing can solve complex math problems far beyond today’s supercomputers. In finance, it could change derivatives pricing and money management. It could even break old encryption. This would need new quantum-safe crypto. It could lead to AI models with unmatched prediction power.

- Explainable AI (XAI): The need for XAI will grow as AI use grows. XAI makes AI choices clear and understandable. XAI success will build trust in AI systems greatly. It will help with rule approval. It will let finance pros use AI’s ideas fully. This closes the gap between AI’s power and human oversight. It ensures wise and good AI use.

AI in finance keeps changing. Handling challenges and using chances will define leaders in finance. It will shape a future that is smarter, stronger, and includes more people.

Conclusion

Artificial Intelligence is not a future idea. It is a real force. It changes the financial world. AI changes customer service with smart personal tools. It strengthens defenses with good risk checks and fraud finding. It improves investment plans with trading algorithms and robo-advisors. AI makes operations faster through automation. It speeds up KYC and rule following. It helps fight financial crime.

New chances are many. Financial groups must also fix problems. These include data privacy, computer security, and ethical issues of biased programs. They must also change their workforce. Groups must train their workers constantly. Start by finding a main area in your work where AI can bring quick, clear results. This might be better customer service with a smart chat program. Or it might be better fraud finding with machine learning. Begin your AI journey now. This will unlock growth. It will secure your place in the next era of banking and investments.

`